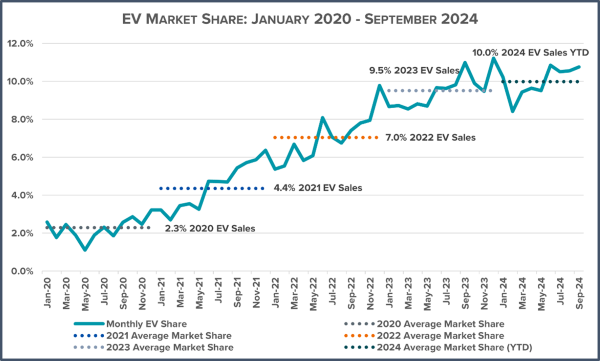

EVs: 10.6 percent of new U.S. light-duty vehicle sales in Q3 2024; up sequentially (9.96 percent in Q2 2024) and year-over-year (10.13 percent in Q3 2023)

125 electric models now available for sale in U.S. – light truck sales 80 percent of EV market

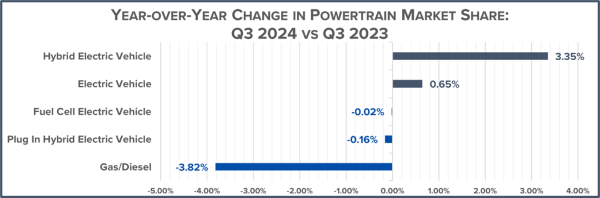

Gas-powered vehicle market share down 3.8 points in Q3 from prior year; down 20 points since 2016

Charging infrastructure lags: only one new public charging port added per 52 new registered EVs

Not achievable: California and states with EV sales requirements

WASHINGTON, DC – Alliance for Automotive Innovation today released its exclusive state-by-state analysis of the U.S. electric vehicle (EV) market for Q3 2024.

The Get Connected Electric Vehicle Report Q3 2024 summarizes EV sales and purchasing trends across all 50 states, a breakdown of light-duty market share by powertrain (2016-2024) and analysis of EV mandates in California and states following its Advanced Clean Cars II (ACC II) program.

Sales up sequentially and year-over-year

- EVs represent 10.6 percent of new light-duty vehicle sales in Q3 2024, up from 9.96 percent in Q2 2024 and 10.13 percent in Q3 2023;

- 125 EV cars, utility vehicles, pickup trucks and van models now available for sale in the U.S. in Q3 2024. Light truck sales represent 80 percent of EV market, down from 84 percent in Q2 2024 and up from 74 percent in Q3 2023;

- 14 states with EV registrations above 10 percent in Q3 2024:

- California (26.8 percent); Colorado (25.5 percent); Washington (24.6 percent); District of Columbia (20.4 percent); Oregon (17 percent); New Jersey (15.6 percent); Hawaii (14.1 percent); Vermont (13.7 percent); Maryland (13.2 percent); Nevada (13.1 percent); Massachusetts (12.3 percent); Delaware (11.9 percent); Connecticut (11.2 percent) and Virginia (10.1 percent).

- 408,688 EVs registered in the U.S. in Q3 2024, an 8 percent increase over Q3 2023;

- Year-over-year, total light-duty sales (all powertrains) increased 3 percent;

- Hybrid electric vehicle market share grew 3.4 percent;

- While internal combustion engine (ICE) vehicle market share contracted 3.8 percent.

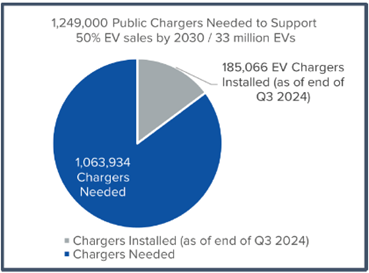

Public EV charging still lags

- In Q3 2024, the number of publicly available EV chargers increased 4 percent from Q2 2024 – while total EVs on the road increased 6 percent;

- Nationwide, 408,688 EVs were registered in Q3 2024 but only 7,794 new public chargers were added – a ratio of 52 new EVs for every new public port;

- There are 5.4 million EVs on the road and a total of 185,124 publicly available charging outlets in the U.S. – a ratio of 29 EVs for every public port;

- More than 1 million more public chargers (928,418 L2 and 135,516 DC Fast) are required to meet the National Renewable Energy Laboratory’s necessary infrastructure estimate for 2030;

- 466 chargers will need to be installed every day – nearly 3 chargers every 10 minutes – through the end of 2030.

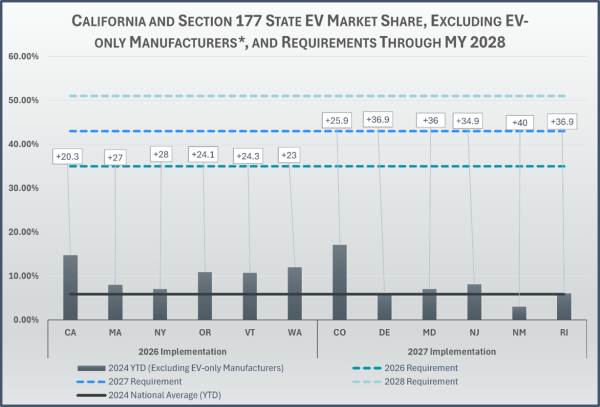

Not achievable: California and states with EV sales requirements

Under the Clean Air Act, vehicle tailpipe emissions rules are set by the federal government (EPA) and govern all vehicles sold in the U.S. The law allows California to set its own emissions standards (using waiver authority from the federal government) and allows other states (known as Section 177 states) to adopt vehicle standards identical to California.

- There are 11 Section 177 states that follow California’s Advanced Clean Cars II (ACC II) ZEV mandate;

- California, Oregon, Washington State, New York, Massachusetts and Vermont have adopted ACC II starting in model year 2026;

- Colorado, New Jersey, Delaware, Rhode Island, New Mexico and Maryland join the program in model year 2027.

- The mandate requires each automaker to sell a specific (and escalating) percentage of zero emission vehicles starting in model year 2026 through 2035 when 100 percent of new vehicle sales must be ZEV;

- Automakers have three options to meet these sales requirements: sell more EVs, decrease total vehicle sales or buy compliance credits;

- EV-only automakers over comply with California’s standard and are awarded credits other automakers can purchase to comply. The compliance credits available for purchase in the coming years will decrease as requirements rise.

- California and Section 177 state EV market share (removing EV-only manufacturers):

Read the full Q3 2024 Get Connected Electric Vehicle Report.

Sign-up to receive Get Connected EV reports HERE.